Globalior - International Trade Compliance

Globalior is maintained by a panel of expert global trade compliance professionals. The collective knowledge of all contributors includes mastery in trade compliance concepts in areas of tariff classification, Customs valuation, Free Trade Agreements, transfer pricing, supply chain vendor selection, vendor management, Customs audit readiness, Incoterms, special Customs programs and industry specific regulatory expertise

Friday, May 29, 2020

A Simple Key For Hs code Unveiled

Saturday, May 23, 2020

The Smart Trick of HS code classification That Nobody is Discussing

A lot more Acquire a free import-export sample report on desired solutions. We don't give any aid right in promoting or Acquiring any product or service.

As an example, when attempting to classify a drone which has a connected movie digicam and gripping claw – one social gathering may perhaps deem the drone provides the complete product its important character due to features it offers, A different bash might feel that the video digicam presents the merchandise its crucial character on account of the price of the video recording part plus a third party may be on the watch which the gripping claw offers the item it’s necessary character due to fat in the gripping ingredient.

Ready feathers and down and articles or blog posts made of feathers or of down; synthetic bouquets; article content of human hair

Chapter twelve Oil seeds and oleaginous fruits; miscellaneous grains, seeds, and fruits; industrial or medicinal crops; straw and fodder

Need to know what to expect with regard to cargo charges? Enter your data into our free freight fee calculator for an estimate:

The Harmonized System is accustomed to ease worldwide trade by producing unified categories to classify different kinds of goods.

The acceptance and flexibility of your HS code as being a universal financial language and code for merchandise has made it an indispensable tool for international trade, integrated into quite a few customs clearance devices around the world.

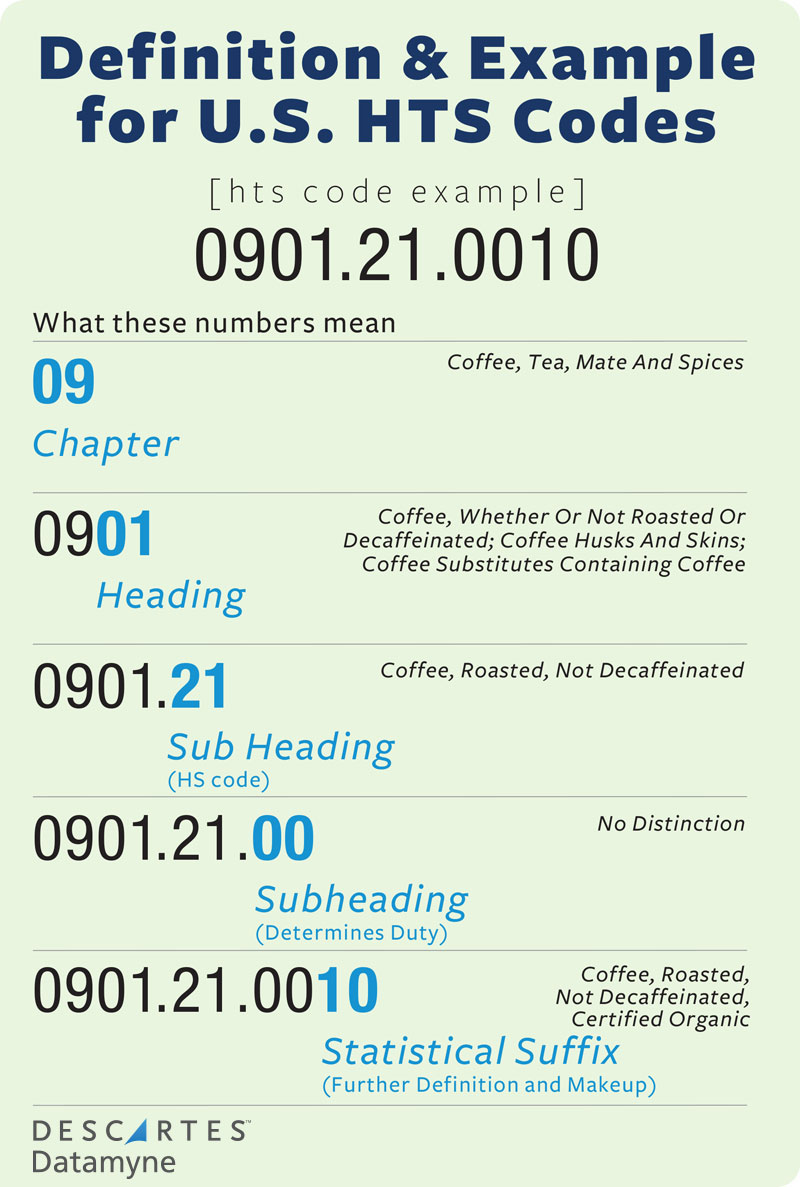

The volume of digits inside a tariff classification can vary from place to country. Such as, Singapore’s tariff eBook maintains eight-digit HS codes, whilst Thailand’s tariff eBook maintains eleven-digit HS codes. In principle, the main six digits from the HS code for virtually any merchandise would be similar throughout all international locations.

Expense breakdowns of element resources and their respective portions revealed in percentages if possible

Chapter forty-two: Articles or blog posts of leather; saddlery and harness; journey goods, handbags, and very similar containers; articles of the animal intestine (apart from the silk-worm intestine)

Prior to the introduction of the Harmonized Process in 1988, Each individual item had to be categorized beneath differing tariff techniques of varied international locations. This slowed down and sophisticated Intercontinental trade, rendering it very hard to do enterprise in many international locations.

These conditions subject when browsing with Free Trade Settlement text, as numerous trade pacts determine originating regulations when it comes to tariff shifts that could be particular into the Heading or initially Sub-Heading stage.

This code is utilized by many Worldwide businesses, governments with the reasons for taxes, trade procedures, checking, the placing of freight and transportation tariffs, gathering of transportation and trade figures, and economic exploration and analysis among other employees. It doesn't issue what manner of transportation you will be using.

Though every single merchandise and every part of each solution is classifiable within the HS, hardly any are explicitly described while in the HS nomenclature. Any solution for which there's no express description might be labeled less than a "residual" or "basket" heading or subheading, which offer for Other items. Residual codes Ordinarily arise final in numerical purchase beneath their associated headings and subheadings.

Friday, May 22, 2020

what are hs code Things To Know Before You Buy

We’ll allow you to comprehend both devices, why they subject, and the way to apply them appropriately. We’ll also Offer you some assets to assist you to dig deeper into distinct things Which might be applicable to your online business.

The good thing is, precision, agility and scalability of HS code classification is now actuality with today’s technological innovation.

On top of that, the purpose of the HS Code is always to Enhance the efficiency and usefulness of each and every country’s customs authorities. This method allows Just about every country to use tariffs, observe trade and perform financial and statistical Assessment at a variety of ranges and for different purposes.

The U.S. Business Service Business office Situated near you. The Business Service is a wonderful source for organizations that want to start out or grow their exports. You will discover a Listing of neighborhood workplaces on their Web site.

This may save you time, cash and trouble and maximize your likelihood of staying about the Safe and sound aspect when clearing the goods by way of customs.

Nowadays, HS codes are employed thoroughly in Digital messages just like the EDIFACT. This has designed it less complicated to the program to be a worldwide conventional for describing a very good across a variety of platforms.

Handling imports and exports is easier with UPS® technological innovation. See how we may also help decrease customs holds, retain delicate knowledge safe and much more.

Animal or vegetable fats and oils and their cleavage items; prepared edible fats; animal or vegetable waxes

Ahead of the introduction of the Harmonized System in 1988, Just about every merchandise had to be labeled beneath differing tariff devices of assorted countries. This slowed down and complicated international trade, rendering it quite challenging to try and do business enterprise in lots of countries.

Additionally it is crucial to possess the routine B and HS numbers in order that your online business’ fulfillment workforce are finishing their export paperwork.

I possess the HS code and that is 8802.2000. I want to know what are the requirements or what sort of paper get the job done is necessary to carry it to India by way of customs safely and securely. What will be the obligation and various taxes?

Each and every imported or exported merchandise is assigned an HS classification code. The code describes simple item parameters to work out customs duties & taxes. A normal HS code consists of six digits that time for the item classification/type.

Tuesday, May 19, 2020

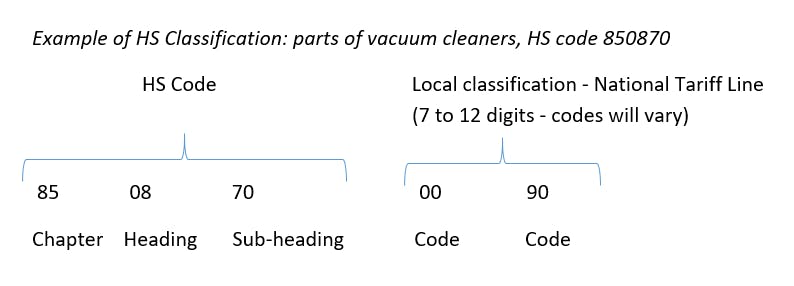

Basic concepts of HS Classification.

HS or Harmonized System for the classification of products traded cross border is a nomenclature used to categorize goods for Customs declarations. Customs in many parts of the world will decide what license requirements are necessary and what duties must be paid based on the HS code of the product. Theoretically, the descriptions for HS code Headings in the tariff book for all countries are harmonized to the first 6 digits.

The HS classification book consists of about 5,300 headings and subheadings. These are grouped into 21 Sections that span 99 Chapters. In theory, the WCO tariff book arranges product descriptions from raw states to more complex products. The process of HS classification is carried by applying 6 rules of tariff classification, of which the first 4 are applied in consecutive order. These rules are known as the general interpretative rules of classification. However, the application of these rules can give varied results as some elements of these rules are open to interpretation. For example, the concept of essential character plays a big part in the classification of any composite product or mixture. However, there is no fixed way to determine the essential character and it can be determined based on factors such as the value, function, weight and/or size of the sub-components of the product.

Some Customs organizations allow traders to submit ruling requests. These requests will result in a legally binding decision from Customs on the HS code to use for any product. This protects the importer from future challenges from Customs on the HS codes declared for imports. Applying for a ruling will typically require that the trader provides extensive documents to Customs authorities. This could include intellectually protected information, blueprints, recipes, or ingredient lists. Hence, traders should be prepared to release this information to Customs if they choose to apply for a ruling. Once a ruling result is provided, the trader no longer has an option but to use the HS code provided by Customs. SEO Service

The use of wrong HS codes when making import declarations is a common issue that Customs audits discover. Customs can choose to claw back unpaid duties from traders if audits reveal that the trader paid lower duties due to the use of a wrong HS code. Also, if the wrong HS code was used with a Free Trade Agreement, it is also possible for the Customs authorities to claw back the duty waiver enjoyed. Depending on the laws in different countries, Customs can choose to scrutinize imports over an extended period of between 2 to 5 years. So the total penalty can be a significantly large amount.

It is usually highly recommended for all

traders involved in import and export activities to maintain a comprehensive HS

classification compliance program. This includes regular reviews and audits by

a third-party auditor. Any published rulings should be reviewed periodically

and an assessment needs to be made if the ruling outcome is material to the

products traded by the business. Since the rules of classification are not easily

understood and applied by most traders, it is best for new traders to seek a

professional’s help to do classification for complex products or to apply for

a ruling. Wrong HS codes are not something easily corrected over time and it is

best to avoid making a wrong classification in the first place.